The IMF and Sovereign Debt

Public debt, or sovereign debt, is an important way for governments to finance investments in growth and development. However, it is also critical that governments are able to continue servicing their debt and that their debt burden remains sustainable. Entering into debt distress is often a painful process, which may threaten macro-economic stability and set back a country’s development for years. Supporting member countries in managing debt risks and resolving debt distress is therefore at the heart of the IMF’s work. This work takes multiple forms.

The IMF’s analytical work helps identify sovereign debt risks and provides policy advice on how to address these risks at an early stage. Jointly with the World Bank, the IMF fosters debt transparency and supports countries in strengthening their capacity to report and manage their public debt. Technical support to member countries on formulating a debt management strategy and developing their local currency bond markets are at the core of such assistance that promotes a prudent debt structure and adds resilience to withstand economic shocks.

Countries with high debt vulnerabilities need to tackle them through a combination of adjustment and measures to restore growth. An IMF-supported program can facilitate that adjustment, but the IMF can only lend to a member if its debt is sustainable. There are cases where debt is unsustainable, even taking the adjustment efforts into account. If a member country enters into debt distress, only the country’s government can decide whether to solve this by negotiating a debt restructuring with its creditors. An IMF-supported program can support a member in the context of a debt restructuring by providing sound economic policies and new financing, enabling the return to macroeconomic viability. The IMF is also lending its support to improving the international architecture for sovereign debt restructurings, which is critical to enable faster and more effective debt reduction.

- Review of the Debt Sustainability Framework For Market Access Countries

- Staff Guidance Note on the Sovereign Risk and Debt Sustainability Framework for Market Access Countries

- Modification to the Transparency Policy

- Policy Papers on Debt-Sustainability in Low-Income Countries

- Review of the Debt Sustainability Framework for Low-Income Countries

- Staff Guidance Note on the World Bank-IMF Debt Sustainability Framework for Low-Income Countries

- The Common Framework: Utilizing its Flexibility to Support Developing Countries’ Recovery

- World Bank Group and International Monetary Fund Support for Debt Relief under the Common Framework And Beyond

Highlights

Recent Event: IMF High-Level Panel | Shoring Up Debt Sustainability, April 6, 8:30 am ET

Past Event: Sovereign Domestic Debt Restructuring - Handle with Care, December 1, 2021

Past Event: Averting a COVID-19 Debt Trap, Tuesday, April 6, 2021

Past Event: Tackling Debt Vulnerabilities: The Way Forward, December 15, 2020

Learn More

- Questions and Answers on the IMF’s Sovereign Arrears Policies

- Guillaume Chabert, Martin Cerisola, and Dalia Hakura on the Challenges of Debt Restructurings in Low-Income Countries

- Ceyla Pazarbasioglu on Current Sovereign Debt Challenges and Priorities in the Period Ahead

- Questions and Answers on Sovereign Debt Issues

- Questions and Answers on the New Sovereign Risk and Debt Sustainability Framework for Market Access Countries

- Debt Sustainability Analysis Low-Income Countries

- Dangerous Global Debt Burden Requires Decisive Cooperation

- Restructuring Debt of Poorer Nations Requires More Efficient Coordination

- The G20 Common Framework for Debt Treatments Must Be Stepped Up

- Sovereign Domestic Debt Restructuring: Handle with Care

- A Future with High Public Debt: Low-for-Long is not Low Forever

- Keeping it Local – A Secure and Stable Way to Access Financing

- Time is Ripe for Innovation in the World of Sovereign Debt Restructuring

- Reform of the International Debt Architecture is Urgently Needed

- The Pre-Pandemic Debt Landscape—and Why It Matters

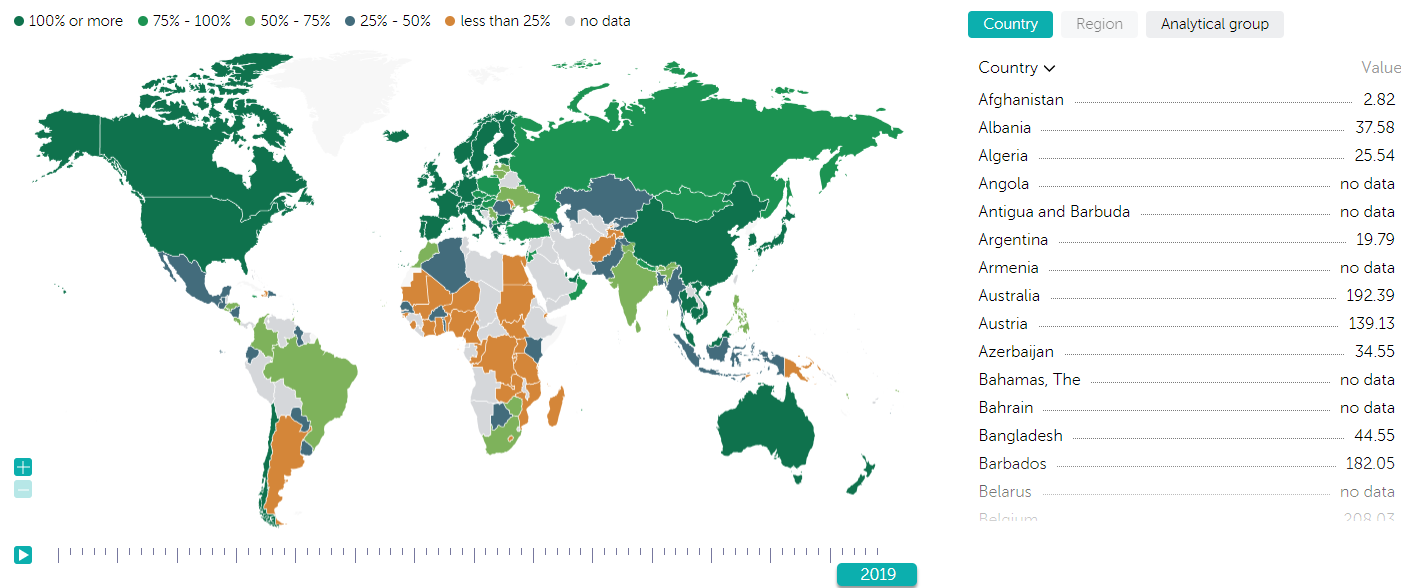

IMF Data Mapper: Global Debt Database

Focus Areas

Issues around debt are complex and country-specific, and the IMF is taking a careful and deliberate approach to help member countries address them. The IMF’s work to support its members in ensuring debt sustainability and addressing sovereign debt challenges takes the following, mutually reinforcing and partly overlapping, forms:

Multimedia

Other Resources

- Developing Government Bond Markets – A Handbook

- Sovereign Debt - A Guide for Economists and Practitioners (co-publication of IMF and Oxford University Press)

- Debt and Entanglements Between the Wars

- External Debt - Definition, Statistical Coverage and Methodology

- Public Sector Debt Statistics - Guide for Compilers and Users

- Guidelines for Public Debt Management

- Training on Medium-Term Debt Management Strategy

- Public Debt, Investment, and Growth: The DIG and DIGNAR Models (DIGx)

- Debt Sustainability Analysis

- Debt Sustainability Framework for Low Income Countries

- Public Sector Debt Statistics

Abebe Aemro Selassie on Africa's Infrastructure Gap and Debt

Abebe Aemro Selassie on Africa's Infrastructure Gap and Debt Fanwell Bokosi on Taming Africa’s Debt Beast

Fanwell Bokosi on Taming Africa’s Debt Beast