Introduction

Fiscal policy affects macroeconomic stability, growth, and income distribution. Citizens expect their governments to ensure value-for-money for public spending, a fair and efficient tax system, and transparent and accountable management of public sector resources.

The IMF has been a leading source of fiscal policy and management expertise worldwide. The IMF monitors and analyzes global fiscal trends and advises IMF member countries on fiscal issues directly. This page highlights the main fiscal policy issues currently under discussion, as well as provides links to research, publications, and commentary.

Current Fiscal Issues Fiscal Monitor: Policies for the Recovery

Fiscal Monitor: Fiscal Policy from Pandemic to War

Chapter 1: Fiscal Policy from Pandemic to War

This chapter discusses how fiscal policy operates amid a sharp rise in uncertainty caused by the war in Ukraine, rising inflation and interest rates, slower economic growth, and increasing debt vulnerabilities. Amidst pandemic legacies and the war, fiscal policy needs to address the humanitarian crisis and economic disruption while being flexible and ready to adjust as the outlook becomes clearer

Chapter 2: Coordinating Taxation Across Borders

As countries strive to promote an inclusive and green recovery from the COVID-19 pandemic—and formulate responses to the immediate impacts of increased energy prices—they face shared challenges to secure tax revenues, address inequalities, and reduce greenhouse gas emissions. National tax policies are under pressure to deal with cross-border spillovers—one country’s action affects other countries. This chapter discusses how international coordination on tax matters (i) reduces profit shifting by multinationals and tax competition between countries; (ii) improves tax enforcement by lifting the veil of secrecy to tackle tax evasion; and (iii) limits global warming. The current energy crisis reinforces the case for coordination among major emitters to reduce reliance on fossil fuels, urging countries to not allow near-term responses to detract efforts to establish credible policies for emissions reductions in the medium term.

The Special Series notes are produced by IMF experts to help members address the economic effects of COVID-19. The series addresses issues in tax policy, tax administration, public financial management, expenditure policy, and macro-fiscal policies.

Global debt

Global debt is at all times high.

Blogs

Governments Need Agile Fiscal Policies as Food and Fuel Prices Spike

Tax Coordination Can Lead to a Fairer, Greener Global Economy

Dangerous Global Debt Burden Requires Decisive Cooperation

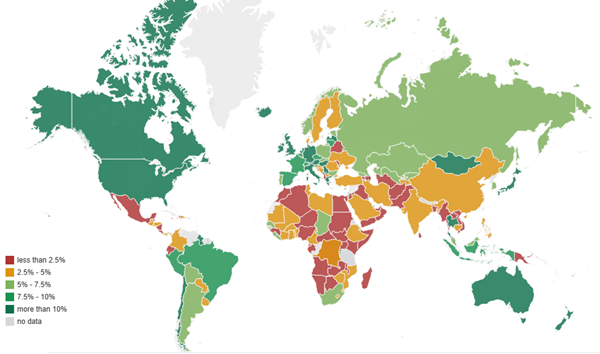

Personal Income Tax Has Untapped Potential in Poorer Countries

Poor and Vulnerable Countries Need Support to Adapt to Climate Change

Working Papers

Social Versus Individual Work Preferences: Implications for Optimal Income Taxation

Crypto, Corruption, and Capital Controls: Cross-Country Correlations

Patterns and Drivers of Health Spending Efficiency

Trust What You Hear: Policy Communication, Expectations, and Fiscal Credibility

Gendered Taxes: The Interaction of Tax Policy with Gender Equality

A Medium-Scale DSGE Model for the Integrated Policy Framework

Progress of the Personal Income Tax in Emerging and Developing Countries

Fiscal Rules and Fiscal Councils: Recent Trends and Performance during the COVID-19 Pandemic

Country Reports

Albania: Enhancing Tax Administration Capacity During Challenging Times

Albania: Technical Assistance Report-Tax Policy Reform Options for the MTRS

Benin: Technical Assistance Report—Fiscal Transparency Evaluation

Maldives: Technical Assistance Report-Revising the Fiscal Responsibility Act

Peru: Technical Assistance Report-Tax Regime for Small Taxpayers and Special Economic Zones

Samoa: Technical Assistance Report—Climate Macroeconomic Assessment Program